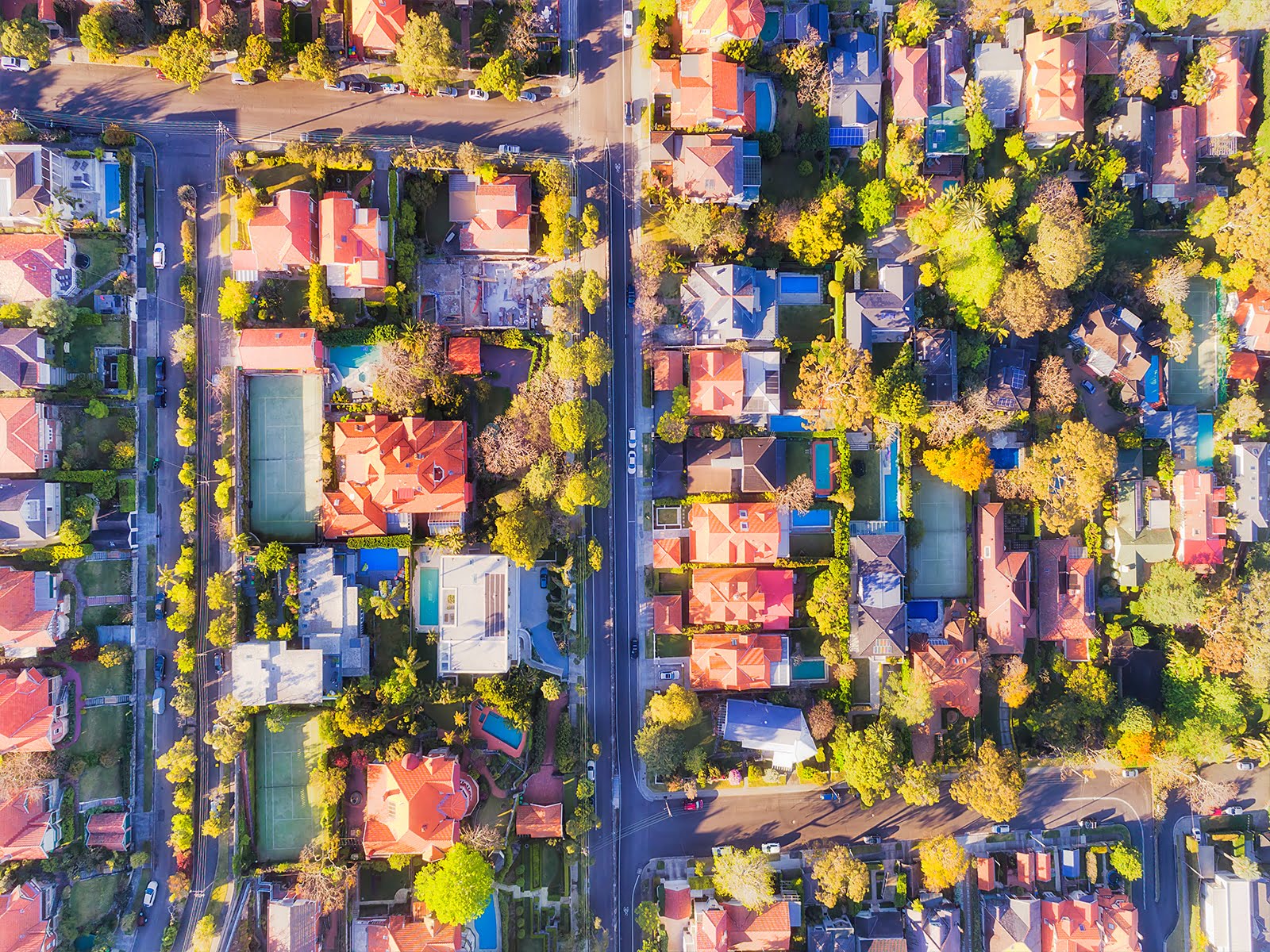

A Guide to Buying Investment Property in Brisbane

The Sunshine State capital, Brisbane, is Australia’s third largest city – but hasn’t historically drawn the sort of interest you […]

Wallaby legend’s oceanfront home sells for 6 million in lightning fast deal

A Dover Heights oceanfront home owned by Wallaby legend John Bosler has sold for more than $6 million even before […]

Top buyer’s tips for 2020

The unusual conditions of the property market at the start of 2020, offer both a myriad of challenges and […]

End of 2019 Market Report

An ideal climate for a market recovery Buyers waiting for the perfect price window to purchase their next property should […]

A guide to buyer’s agents and their fees, part II

Questions about buyer’s agents’ fees form a key part of initial talks between agents and their potential clients. It’s a […]

Housing market rebound is gathering pace

Housing market rebound is gathering pace Home value trends in October have continued their upward trajectory, inching their way back […]

A guide to buyer’s agents and their fees. Part 1

How do you know when you’re getting what you want, and what you’re paying for when it comes to buyer’s […]

Why home values are tracking higher

As September came to a close, there was light at the end of the tunnel for the property market as […]

North v East: How to find your ideal address

One of Sydney’s most common property dilemmas is whether to buy in the city’s Eastern Suburbs or on the North […]

How to make the most of Melbourne

Melbourne has long worn the World’s Most Liveable City crown but, these days, it’s also becoming known as the […]

The three vitals signs pointing to a property market recovery.

As August drew to a close, key metropolitan property markets showed signs of solid recovery after almost two years of […]

BUYING PROPERTY THE RIGHT WAY

How to buy property – the right way Are you searching for your next home? Looking for an investment property? […]